Venture Capital in Cleantech and Climate Holds Strong Amid Tech Downturn

Venture capital funding in cleantech and climate has notably held up better than other tech sectors in the recent VC downturn, on the back of continued market growth and investor demand in key drivers in renewables and EVs, and emerging growth markets in hydrogen and carbon, as well as expanding government support.

ETV’s Portfolio Shows Strength and Selectivity

But even inside climate and cleantech, ETV’s portfolio is heating up. ETV remained very selective in the hot 2021 and 2022 markets and is seeing dividends now from that selectivity for high-quality teams with advantaged technologies, alongside great investors that were built for success in any market.

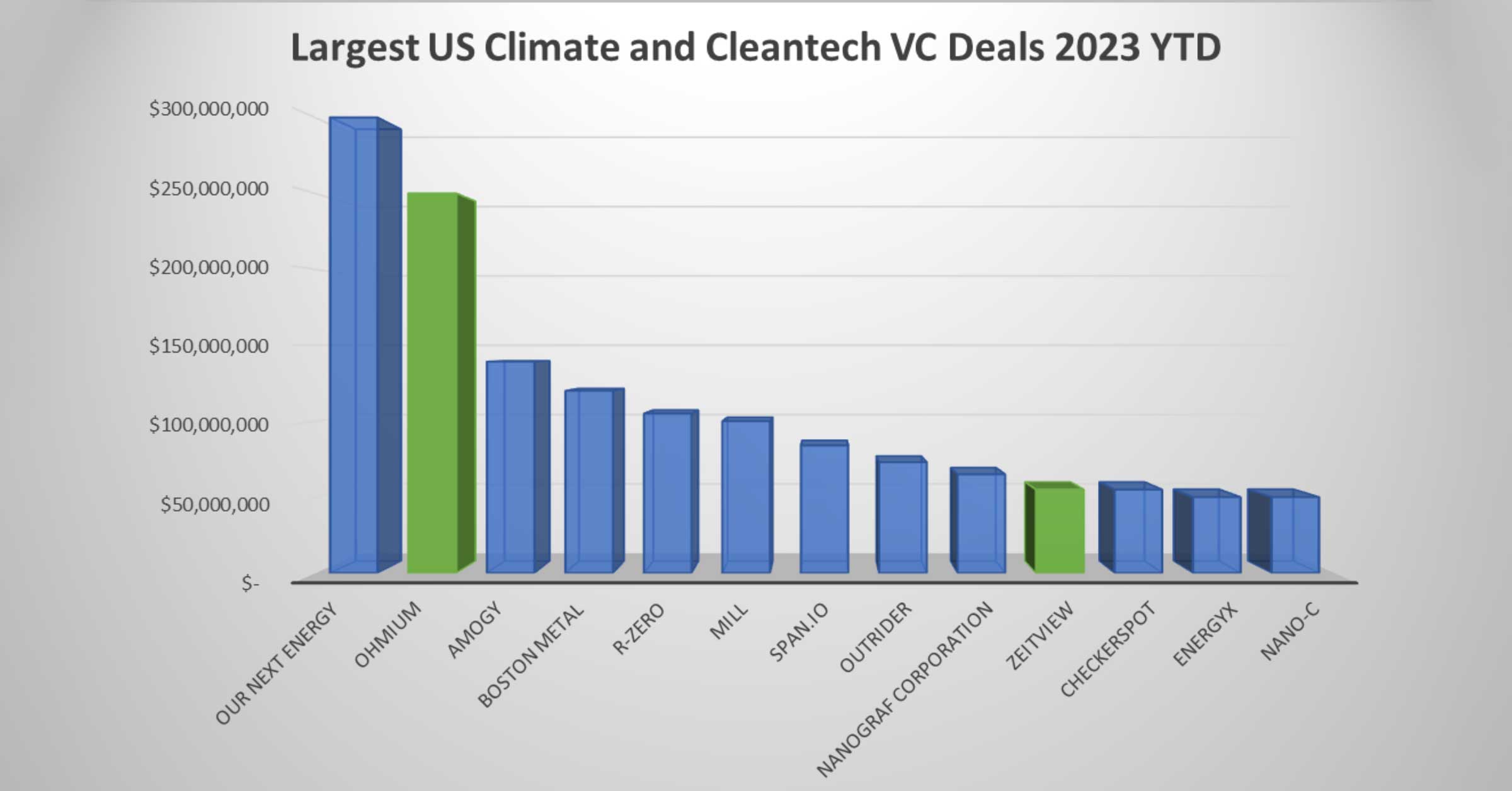

Dronebase Rebrands as Zeitview After $55 Million Round

In 1Q23, Energy Transition Ventures’ first investment, Dronebase, announced a $55 mm round led by Valor Equity Partners, and rebranded as Zeitview. This round was one of the top 10 largest US venture rounds in climate and cleantech announced in the first quarter. Zeitview continues to grow its revenues quickly and is expanding from the built environment, solar, and wind into telecom and utilities segments as well to drive what ETV sees as the “oilfield services company” of the future.

Ohmium Secures $250 Million Series C for Green Hydrogen Electrolyzers

This week in 2Q23, ETV’s green hydrogen electrolyzer portfolio company, Ohmium, announced its Series C round, $250 mm led by longtime energy sector powerhouse TPG. The Ohmium team will be at OTC in Houston next week showing off the lowest cost, most advanced PEM electrolyzer technology on the market. The company is actively seeking project developers, EPC, and operator customers in green hydrogen globally, as it takes additional orders for its expanding 2GW/year electrolyzer manufacturing plant in India.

ETV Portfolio Boasts Top Venture Rounds in Climate and Cleantech

The combination gives the ETV portfolio 2 of the top 10 largest announced venture rounds in climate and cleantech in the US in 2023.

ETV Expands Investments in Key Climate and Cleantech Sectors

After 24 months in the market ETV has now invested in the key sectors driving climate and cleantech, EVs/Grid, CCU, Hydrogen, and Renewables and had the opportunity to coinvest now alongside top tier investors USV, Amazon, GS Group, Euclidean, Valor, Fenice, and now TPG.

ETF I Fund: Backing New Teams with Strategic Selectivity

The ETF I fund, backed by top-tier strategic, institutional, and family office investors from Korea and the US, maintains plenty of dry powder to back new teams and its existing portfolio as a result of its selectivity. To date, ETV has invested 100% of its capital in first-time founders and is actively looking for founders with advantaged technologies and good paths to break open new markets to back and help, from seed to growth stage.

Energy is Life.

The Rest is Just Details.

Share this Post